Circle Of Life Insurance

Circle Of Life Insurance: Well, what do you know? Standard Life has decided to withdraw from the protection market. After months of deliberation, the company finally chose to pull the plug on its protection business after admitting that the market was simply too competitive for what it had to offer.

Given that the protection business represents less than 1% of Standard Life’s total turnover and the protection market share is only 0.6% in 2006, according to figures from the Association of British Insurers, the move comes as no surprise.

Some experts suggested that Standard Life was making a last-ditch effort to save its protection arm by bidding on resolution. However, the insurer was outbid at the last minute by Pearl, who offered a better deal, leaving Standard Life no choice but to give up.

So what does this mean for the industry? Not much seems to be the consensus. Because Standard Life’s share of the protection activities was so small, the exit will have no real impact.

Instead, the industry has much to look forward to in the new year, with other companies reportedly set to enter the market within the next 12 months, with Fortis expected to unveil its new protective arm early next year.

So while it’s unfortunate to see such a well-known brand pull out, its exit will leave more room for more competitive and innovative protection brands to flex their muscles.

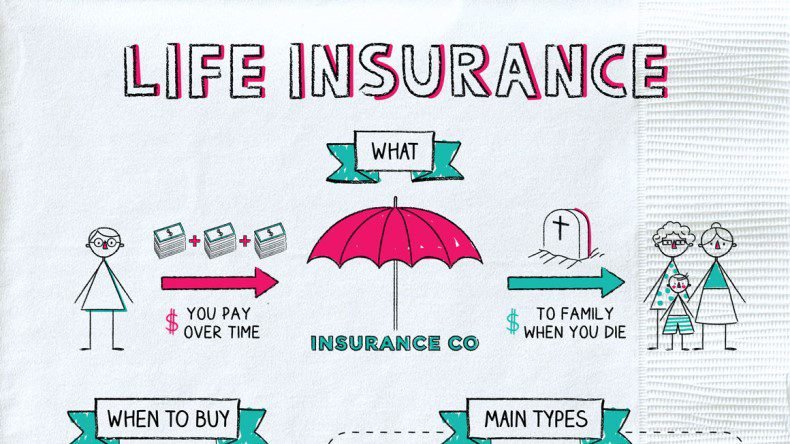

The key concept for Circle of Life Insurance

An important concept is that the amount of money needed to achieve these goals changes over time, and therefore the life insurance coverage that is needed also changes; normally low.

The blue bar graph illustrates from left to right how a person’s life insurance needs can change over time.

On the far left, there is very little need for life insurance for a child.

For young adults (and those who are young at heart), the following three life events can occur in different order for different people. In this example,

- Marriage (or life in free engagement) occurs first and can generate the need for life insurance if the new couple so desires.

- Buying a house and taking out a mortgage generally increases the need for life insurance as most couples prefer the surviving spouse to keep the house.

- The greatest need for life insurance occurs when parents are expecting a child who will be the last/youngest child (see target 5 above). The sum of money it takes to replace one parent’s net income for 25 years (indexed for inflation) is typically over a million dollars!

As the years go by, presumably the mortgage and other debts are gradually being paid off, the children’s educational goals are gradually being funded by RESP contributions, and the children themselves are getting closer to financial independence.

During parental retirement, the need for life insurance is much less (there may still be goals for life insurance to pay income tax obligations, funeral expenses, charitable contributions, and create a family trust for the descendants).

Why Do You Need Circle Of Life Insurance?

For a family, the need for parental life insurance stems from the following potential financial goals:

- Having enough money to pay the mortgage and other debts in full to relieve the family of these payments. Note: As long as the mortgage interest rate is low, it is best to continue with the mortgage. Instead, invest the money you receive from life insurance and then earn a monthly income for mortgage payments. Note: Mortgage insurance is not recommended (see below).

- Give the surviving spouse a sum of money to take a few months off if necessary.

- Provide a sum of money to fully realize the children’s learning goals.

- Have a sum of money to fully fund the surviving spouse’s retirement.

- Its main purpose and need are to have a sum of money (often referred to as an “income replacement fund”) from which to take a monthly income to cover the family’s regular living expenses (including new expenses for Daycare). This income must continue to exist, indexed for inflation, until all children are financially independent.

- Payment of funeral expenses.

- Donate to charities, if desired.

- The establishment of a long-term family trust for the benefit of children and grandchildren.