whole life insurance rates by age chart

In this article, we look at whole life insurance rates by age chart and help you understand the cost of whole life insurance.

Whole life insurance is a type of permanent life insurance policy that provides coverage for the entire life of the policyholder. One of the biggest factors that affect the cost of life insurance is the age of the policyholder.

At What Age Should You Take Out Life Insurance?

The best time to get life insurance is when you are young and healthy. The younger you are when you take out life insurance, the lower your premium will be. This is because the risk of death or illness is lower for younger people. It is recommended that you get a whole life insurance policy as soon as possible, ideally between the ages of 20 and 30.

How Much Does A Whole Life Insurance Policy Cost?

The cost of a whole life insurance policy depends on several factors such as your age, gender, health condition, occupation, and lifestyle. According to a study by Policygenius, the average cost of a $250,000 whole life insurance policy for a healthy 35-year-old man is about $4,015 per year, while the cost for a healthy 35-year-old woman is about $3,475 per year.

How Much Is A 50k Life Insurance Policy?

The cost of a $50,000 whole life insurance policy varies based on your age, gender, health condition, and other factors. In general, the younger and healthier you are, the lower your premium will be. According to Quotacy, the average cost of a $50,000 whole life insurance policy for a healthy 30-year-old man is about $48 per month, while the cost for a healthy 30-year-old woman is about $39 per month.

What Is The Minimum Amount For A Lifetime?

The minimum amount for a life insurance policy varies by insurance company. However, most insurance companies offer life insurance policies with a minimum death benefit of $25,000. Some companies offer policies with lower death benefits, but they are generally not recommended because they may not provide adequate coverage.

Full Life Insurance Costs At Age 65

The cost of whole life insurance at age 65 depends on several factors, such as your gender, health condition, and the amount of coverage you need. According to Policygenius, the average cost of a $250,000 whole life insurance policy for a healthy 65-year-old man is about $11,970 per year, while the cost for a healthy 65-year-old woman is about $9,805 per year.

Life Insurance Cost Calculator

A life insurance cost calculator can help you estimate the cost of a whole life insurance policy based on your age, gender, health condition, and other factors. Some popular life insurance calculators include those from Policygenius, Quotacy, and NerdWallet.

Minimum Age For Whole Life Insurance

The minimum age for a life insurance policy varies by insurance company. However, most insurance companies offer life insurance policies for people up to the age of 18. Some companies may require people to be at least 21 years old before they can purchase a whole life insurance policy.

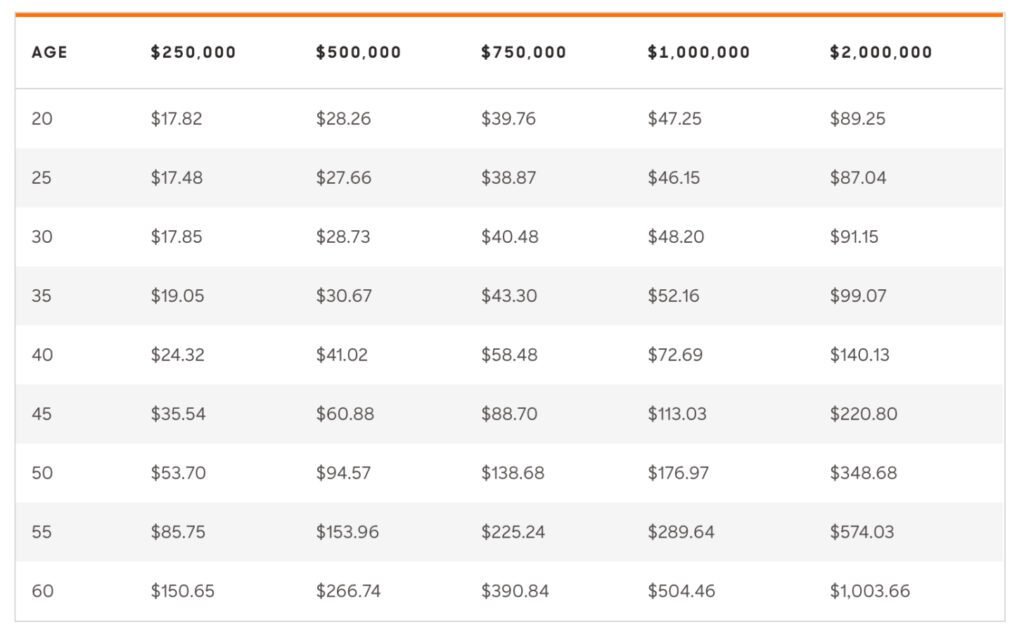

Rate Chart For Term Life Insurance For 10 Years By Age

Term life insurance is a type of life insurance policy that provides coverage for a specified period of time, usually 10 to 30 years. The rates for term life insurance per age table differ from the rates for life insurance. According to Policygenius, the average cost of a 10-year term life insurance policy for a healthy 35-year-old man is about $20 per month, while the cost for a healthy 35-year-old woman is about $16 per month.

How Much Is Life Insurance Per Month?

The cost of a whole life insurance policy per month varies based on several factors, including your age, gender, health condition, and the amount of coverage you need. According to a ValuePenguin study, the average cost of a $250,000 life insurance policy for a healthy 30-year-old man is about $212 per month, while the cost for a healthy 30-year-old woman is about $179 per month.

Rate Chart For Term Life Insurance

As mentioned above, term life insurance is a type of life insurance policy that provides coverage for a specified period of time. The rates for term life insurance per age table differ from the rates for life insurance. According to Policygenius, the average cost of a 20-year term life insurance policy for a healthy 35-year-old man is about $25 per month, while the cost for a healthy 35-year-old woman is about $21 per month.

Cost Of Life Insurance At Age 62

The cost of life insurance at age 62 depends on several factors, including your age, gender, health condition, and the amount of coverage you need. According to a Quotacy study, the average cost of a $250,000 whole life insurance policy for a healthy 62-year-old man is about $588 per month, while the cost for a healthy 62-year-old woman is about $461 per month.

Average Life Insurance 1950

The cost of a 1950s life insurance policy varies depending on several factors, including the type of policy, the level of coverage, and the person’s age, gender, and health condition. However, according to a study by LIMRA, the average annual premium for a $1,000 whole life insurance policy in 1950 was about $20.

Canadian Life Insurance Rates By Age

Life insurance rates by age table in Canada are different than in the United States. According to a study by PolicyAdvisor, the average cost of a $250,000 whole life insurance policy for a healthy 35-year-old man in Canada is about CAD$2,234 per year, while the cost for a healthy 35-year-old woman is about CAD$1,812 per year.

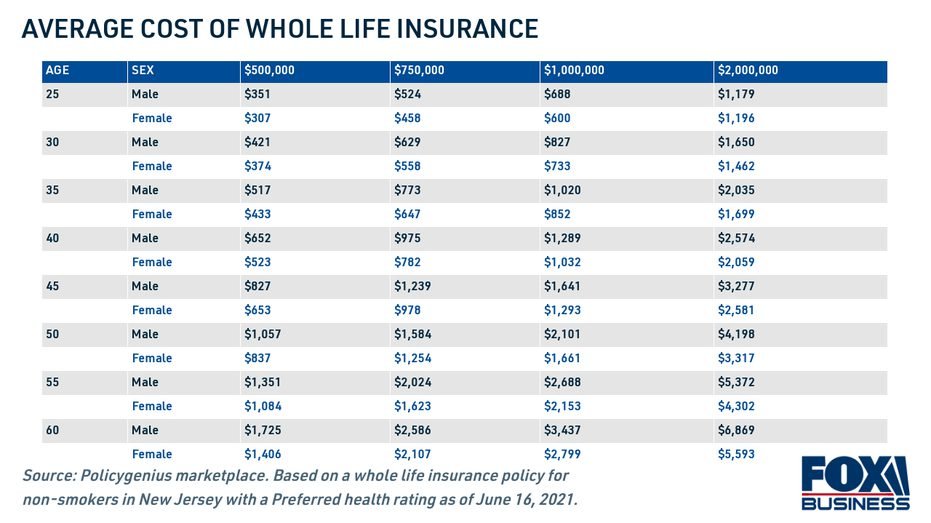

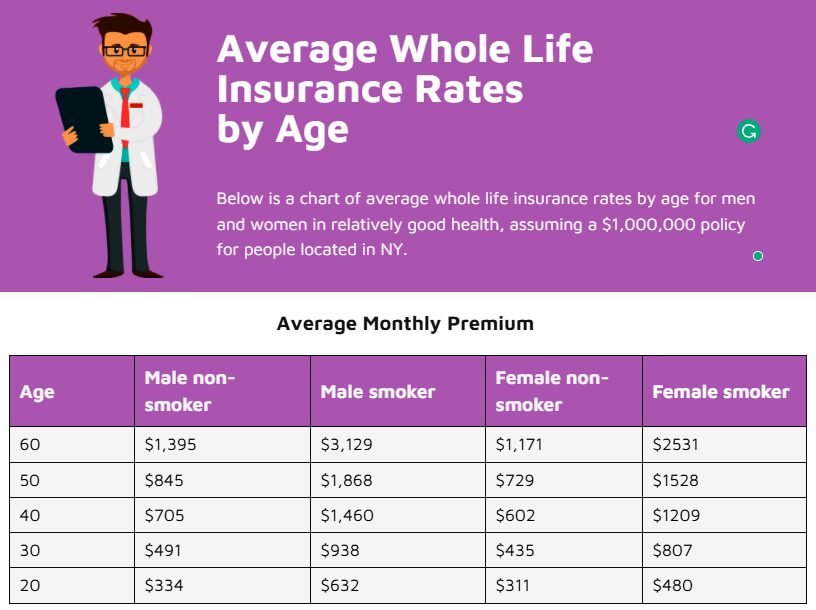

Average Whole Life Insurance Rates By Age

Average life insurance rates by age vary based on several factors, including your age, gender, health condition, and the amount of coverage you need. According to a study by Policygenius, the average cost of a $250,000 whole life insurance policy for a healthy 30-year-old man is about $3,370 per year, while the cost for a healthy 30-year-old woman is about $2,835 per year.

Rate Chart For Life Insurance

The life insurance rate chart estimates the cost of life insurance based on your age and the amount of coverage you need. The rates in the table differ per insurance company and the specific conditions of the policy.

What Is A Good Rate For Life Insurance?

A good life insurance rate varies based on several factors, including your age, gender, health condition, and the amount of coverage you need. It is recommended that you compare quotes from different insurance companies to find a good rate that fits your needs and budget.

Life Insurance Rate Chart By Age

The Age-by-Age Life Insurance Rate Chart estimates the cost of life insurance based on your age, gender, and the amount of coverage you need. The rates in the table vary depending on the type of policy, the insurance company, and the specific conditions. It is important to note that the rates in the table are estimates only and the actual cost of life insurance may vary based on your individual circumstances.

How Much Does The Average Life Insurance Policy Cost?

The average cost of a whole life insurance policy varies depending on several factors, including your age, gender, health condition, and the amount of coverage you need. According to a ValuePenguin study, the average cost of a $250,000 life insurance policy for a healthy 30-year-old man is about $3,370 per year, while the cost for a healthy 30-year-old woman is about $2,835 per year.

Conclusion: Whole Life Insurance Rates by Age Chart

Basically, life insurance is a type of life insurance policy that provides coverage for your entire life as long as you pay the premiums. Life insurance rates vary based on your age, gender, health condition, and the amount of coverage you need. It is important to compare quotes from different insurance companies to find a good rate that fits your needs and budget. In addition, it is recommended that you consult a financial advisor or insurance agent to help you make an informed decision about the type and amount of life insurance policy that best suits your needs.