Does Adjusting Your Car Height Void Insurance

Does Adjusting Your Car Height Void Insurance? If you make changes, the car’s overall value will drop. If you wish to maintain the car’s original worth due to the use of unauthorized parts during the modification procedure, you will need to pay an additional premium.

You may make your automobile stand out from the crowd and express your personality while driving by making customizations to it, such as changing the tires and exhaust or modifying the height of your car.

However, those modifications and additions typically result in higher auto insurance premiums, and special parts frequently call for more protection. Because of this, changing the height of your car may result in increased charges.

Does Adjusting Your Car Height Void Insurance?

Does adjusting your car height void insurance? Yes, raising or lowering your car is a type of vehicle modification and requires additional auto insurance coverage.

Many insurance companies offer additional coverage for custom parts and equipment to cover your adjustments if your car is damaged in an accident, but you will pay a higher auto insurance rate for the additional coverage.

What is vehicle modification?

Vehicle modification is defined as custom changes made to a car by the owner. This change changes the look of the car. Some examples of car modification are as follows;

- Replacing the wheel with the alloy rim.

- Notify the car.

- Make a sunroof on the car

- Change the auto-storage system.

- The car tattooed

- Modification of the exhaust system of the car.

All these changes affect the car insurance rate. So financial consequences for the car. It may sound cool, but the insurance company took advantage of this change to lower the car’s value. It doesn’t matter how much you have to spend on the change. If it does not resemble the original model of the car, the value will decrease automatically.

Does lowering the car affect insurance?

Yes, you pay more to insure your car if you have it at a discount. Any vehicle modification will likely increase your insurance costs, but downsizing your car poses specific issues that affect your insurance rates.

Lowering the suspension makes it more difficult to tow your car, creates potentially dangerous interactions between the frame and other components such as the tires or anti-roll bar, and increases the risk of your car sagging on speed bumps and uneven road surfaces.

All of these issues increase the likelihood that you will have to file a claim, driving up your insurance costs.

Does Raising the Car Affect Insurance?

Yes, raising your car will likely affect your auto insurance. Raising the suspension affects the stability of your car, increasing the risk of a rollover when you accelerate or take a sharp turn. The increased risk and additional costs associated with the change will increase your insurance rates.

Do I have to notify my insurance If I Modify my car?

Yes, you must notify your insurance company if you make any changes to your vehicle, including raising or lowering the suspension. Your auto insurance company needs to know when you’re making changes to your car so they can accurately determine your rates.

What happens if you do not inform the insurance company of the changes?

It is important to report any changes to your car to your insurance company. Not informing your insurer of changes is considered a material misrepresentation, which is a fancy way of saying that you didn’t tell them anything that would have affected your rate had they known.

If you do not notify your insurance company of changes made to your vehicle, they may deny a claim in the future or even cancel your policy entirely when they learn about the changes to your vehicle.

How much does insurance increase when raising or lowering a car?

Your insurance rates will increase with a custom car, but the exact amount you pay is based on several factors, including the insurance company you choose.

The easiest way to save money on auto insurance is to compare quotes between multiple companies, which you can do through an online marketplace like AllInsurancetutor.

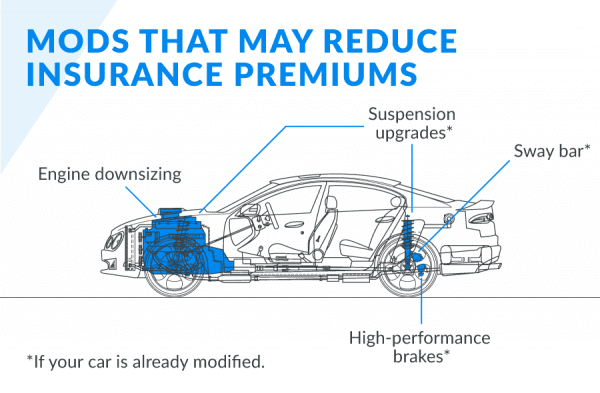

Which modification lowers the issue value?

Is it against your insurance to adjust the height of your car? Virtually all types of changes affect the value. But some adjustments have a big impact. Instead of increasing the total value, the value is decreased. Some of these changes are the following.

- Structural changes in the bodywork.

- There is a custom-painted car with tattoos all over it.

- Modification of auto parts will improve the performance of the car and increase its efficiency.

You should inform the appropriate insurance company if you make all of these changes at once. You also have to pay a higher auto insurance rate. because the likelihood of mishaps and damage increases the following change. For this reason, you must pay a higher insurance premium. Please be aware that the value of the car will fall if the insurance company is not notified at the time of the insurance claim. And the decline significantly affects the car’s worth.

Why does car modification affect insurance?

The fact that the change will have an impact on the car’s value is known to all. Your car’s value will drop if you change the height of the vehicle. It is because the car company has not authorized the mechanical use of certain parts in the vehicle. As a result, none of these components have brands. As a result, the value of the car is impacted by the usage of local modification parts. The only explanation for the car’s value drop following the alteration is this.

Should you alter the business? Additionally, the local automaker employs name-brand components for the alteration that have no impact on the insurance value. Remember that using name-brand auto parts won’t boost the insurance’s value.

Effect on insurance after car modification

The adjustment of the car does not affect the distance policy. It is not the case that the conditions of the insurance change after the modification of the car. It only affects the value of the car. If you have a car modification done with a local mechanic, the total value of the car from the insurance company will decrease.

If you pay the additional premium, the value remains the same. But most people avoid paying the premium because it’s about the same as general insurance premiums. If you are going to convert the car of the same brand, the value of the car insurance remains the same and you do not have to pay a premium. But the customization of the company itself is very expensive, so not everyone can afford it as well.

Required documents after car modification

Certain documents are required after vehicle modification. If you want to claim insurance, you must submit all these documents. A list of some of the documents is as follows:

- A request letter from the policyholder.

- Bill the change

- Car Ownership Documents

- Vehicle Inspection Report

- Physical policy documents received after policy purchase

Be sure to prepare all of these documents before submitting your insurance claim. If you send these documents with the claim request, your claim will be automatically rejected. So to protect your claim, you need to organize these documents. You can ask your insurance broker if additional documentation is required. Because different states have different criteria. Therefore, there may be a minor change in the document lists.

Important points – Does Adsjusting Your Car Height Void Insurance?

- Raising or lowering your car is a type of vehicle modification, which typically requires additional auto insurance coverage.

- Adjusting the height of your vehicle can make towing more difficult, cause dangerous interactions between car parts, or even make it more likely to roll over.

- Those increased risks are why your insurance rates will rise after you adjust the height of your car.

- Failure to notify your insurer of changes is considered a ‘material misrepresentation’ and may result in your insurance company denying a claim or canceling your policy entirely.

Conclusion: Does Adjusting Your Car Height Void Insurance?

In short, car modification is a matter of choice. Some people lie about auto adjustments, while others don’t like it. If you carry out a car modification, there is a good chance that the total value of the car will decrease under insurance conditions. So when adjusting the ride height of your car and other adjustments, think carefully before canceling insurance and other matters. If you use the brand name parts, the value remains the same. But for food, you have to do the proper paperwork. To indicate that all modified car parts have been verified by the car company.

Frequently Asked Questions – Does Adsjusting Your Car Height Void Insurance?

What Factors Affect Auto Insurance?

Many factors affect your auto insurance policy. Some things, such as your age or your driving habits, have a major impact on your insurance rates. Other matters, such as your marital status, have less influence on your rates. Customizing your car affects how much you pay for auto insurance.

Can a lowered car be insured?

Yes, but you will probably pay a higher rate than if you had not reduced the car. Some insurance companies may also choose not to insure a lowered car, so you may not have as many insurance options as you would if you didn’t modify the vehicle.

Does car upholstery affect insurance?

Yes, the trim level of your vehicle will likely affect your insurance rates. Because of the different features that come with different trim levels, you’ll likely pay more to insure a more expensive equipped vehicle.

Which changes must be declared to the insurance company?

Standard car insurance does not cover changes, so you must disclose any changes you make to your car. This includes custom wheels, paint jobs, lift kits, and any other changes you make to your vehicle.