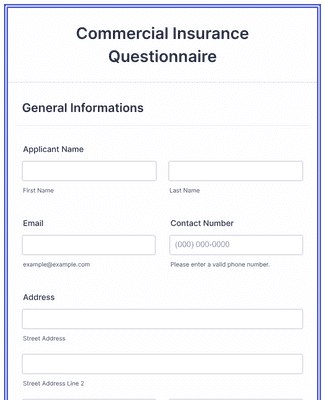

Commercial Insurance Questionnaire

Commercial Insurance Questionnaire: Business insurance is an essential tool for businesses of all sizes, protecting a wide range of risks and liabilities. However, before companies can get coverage, they usually have to fill out a commercial insurance questionnaire. In this blog post, we explore what a business insurance questionnaire is, why it is necessary, and what companies can expect when completing it.

What is the Commercial Insurance Questionnaire?

A commercial insurance questionnaire is a document that companies fill out to provide insurers with information about their activities and potential risks. The questionnaire is designed to help insurers assess the level of risk associated with providing business coverage and determine the appropriate premium to charge.

The questionnaire usually includes questions about the company’s activities, such as the types of products or services offered, the number of employees, and the location of the company. You can also inquire about past claims or losses, security procedures and policies, and other factors that may affect the level of risk associated with the company.

The information provided in the Commercial Insurance Questionnaire is used by the insurance company to assess the level of risk involved in providing coverage for the business and to determine the appropriate terms of the insurance policy. Companies must ensure that the questionnaire is completed accurately and completely, as inaccuracies or omissions may result in insufficient coverage or cancellation of the policy.

The questionnaire usually contains a series of questions designed to help insurers assess the level of risk involved in providing coverage to the business. Questions can cover areas such as:

- Operations: questions about the type of products or services the company offers, the number of employees, and the location of the company.

- Claim History: Questions about previous claims or losses suffered by the company, including the nature and severity of the claims.

- Security Policies and Procedures: Questions about the company’s security policies and procedures, such as fire prevention measures, employee training, and security protocols.

- Other Factors: Ask about other factors that may affect the company’s risk level, such as the age and condition of equipment or the presence of hazardous materials.

Why Is A Commercial Insurance Questionnaire Necessary?

A commercial insurance questionnaire is necessary because it helps insurers assess the level of risk involved in providing coverage for the business. Insurers use the information in the questionnaire to assess the likelihood of claims, estimate the potential costs of those claims, and determine the appropriate premium to charge for coverage.

By completing the questionnaire, companies help insurers gain a more complete understanding of the risks associated with their operations and ensure they are getting the right level of coverage for their needs. The questionnaire can also help companies identify potential areas of risk in their operations and take steps to address those risks and reduce the likelihood of claims.

What can companies expect when completing a commercial insurance questionnaire?

When completing a commercial insurance questionnaire, companies must provide detailed information about their business, claims history, security procedures and policies, and other factors that may affect their level of risk. The questionnaire can be long and require a significant amount of time and effort to complete accurately and completely.

Companies must ensure that they answer all questions truthfully and accurately as inaccuracies or omissions may result in insufficient coverage or cancellation of the policy. It is important to provide as much detail as possible when answering questions to help insurers gain a fuller understanding of the business and potential risks.

After completing the questionnaire, companies can expect a quote from the insurer containing the conditions and costs of the cover. It is important to read the quote carefully and ask questions about coverage or unclear conditions.

Why Every Business Needs a Commercial Insurance Questionnaire?

A commercial insurance questionnaire is a document used by insurance companies to collect information about a company and its activities. It covers a variety of topics from company location and employees to security procedures and claims history. By providing this information, companies can help their insurer assess their risks and provide adequate coverage.

Here are some reasons why every business needs a business insurance questionnaire:

- Ensure Accurate Coverage: By providing detailed information about their business, companies can ensure they are getting accurate and appropriate insurance coverage. If a company does not disclose important information, it risks not being covered for a claim.

- Helps identify risks: The questionnaire can help companies identify risks that they may not have considered before. For example, the questionnaire may ask about employee safety training or fire prevention measures, which could prompt companies to take steps to improve their safety procedures.

- Simplifies the underwriting process: Completing a commercial insurance questionnaire can simplify the underwriting process. Insurers use the information provided to assess business risk and provide adequate cover quickly and efficiently.

- Reduces Costs: Accurate information on a commercial insurance questionnaire can help businesses get the most cost-effective insurance coverage for their needs. Insurance companies can provide more accurate quotes if they have detailed information about a company, which can lead to lower premiums.

- Provides peace of mind: Knowing they have adequate insurance coverage can provide business owners with peace of mind. They can focus on growing their business knowing they are protected from the unexpected.

10 Common Mistakes to Avoid When Filling Out a Commercial Insurance Questionnaire

Completing a commercial insurance questionnaire is an essential part of the insurance process for any business. It is critical to provide your insurer with accurate and detailed information to ensure you get the right coverage for your business needs. However, errors can occur and result in insufficient coverage or even a denied claim. Here are ten common mistakes to avoid when completing a commercial insurance questionnaire:

- Providing incomplete information: Providing incomplete information may result in insufficient coverage. Make sure you answer all quiz questions completely.

- Providing incorrect information: Providing incorrect information may result in claims being denied or coverage that does not apply to your company’s actual needs. Be sure to verify all information before submitting.

- Not Disclosing Past Claims: It is essential to disclose any claims or losses your company has incurred. Failure to do so may result in denial of coverage or higher premiums.

- Not Disclosing All Commercial Activities: Disclosing all commercial activities is critical to achieving accurate coverage. Be sure to include all activities, even if they are not your main focus.

- Not providing accurate employee numbers: Providing accurate employee numbers is critical, as it can impact your premiums and coverage levels.

- Failing to Provide Accurate Revenue Figures: Providing accurate revenue figures is critical to getting the right coverage for your business. Under-reporting your prescription can lead to insufficient coverage.

- Not Providing Accurate Property Values: Providing accurate property values is essential as it can impact your premiums and coverage levels.

- Failure to disclose security measures: Failure to disclose security measures may result in insufficient coverage. Be sure to include any security measures.

- Not reporting changes in business operations: You must report changes in your business operations to your insurer. Failure to do so may result in insufficient coverage.

- Not checking the questionnaire before sending: Checking the questionnaire before sending it is essential to detect errors or omissions. Be sure to verify all information before submitting the survey.

How to Use a Commercial Insurance Questionnaire to Find the Right Coverage for Your Business?

A business insurance questionnaire is a tool that can help you determine the types and amounts of insurance coverage your business needs. Here are some steps to using a commercial insurance questionnaire effectively:

- Get a Commercial Insurance Questionnaire: Contact an insurance agent or broker who specializes in commercial insurance and request a questionnaire. You can also find questionnaires online, but it is best to work with an expert who can guide you and answer your questions.

- Complete the questionnaire: The questionnaire will typically ask about your business operations, assets, and potential risks. Be thorough and honest when answering questions to ensure you get accurate coverage recommendations.

- Assessment Results: After completing the questionnaire, the insurance agent or broker will use the information provided to recommend types and amounts of insurance coverage. Please read these recommendations carefully and ask questions if you are unsure of your coverage options.

- Consider your budget: Insurance premiums can be expensive, so it’s important to consider your budget when selecting coverage. Ask the insurance agent or broker about ways to lower premiums, such as increasing the deductible or bundling coverage.

- Buy coverage: Once you’ve selected the coverage options that fit your business and budget, buy insurance. Read the policy documents carefully and ask any final questions before signing.

- Review and update your coverage regularly: Businesses and risks can change over time, so it’s important to review and update your insurance coverage regularly to make sure you’re adequately protected.

By using a business insurance questionnaire, you can ensure that your business has the appropriate insurance coverage to protect against potential risks and liabilities.

What Happens After You Submit a Commercial Insurance Questionnaire?

After submitting a business insurance questionnaire, the insurer will review the information provided and assess the risks associated with your business. Based on the information provided by you, the insurer determines whether and, if so, what coverage and at what cost it is prepared to cover you.

The insurer may ask you for additional information or conduct an on-site inspection of your business to assess the level of risk. They can also consult insurers or risk managers to help them assess their company’s level of risk.

Once the insurer has assessed your company’s risk level and determined the appropriate coverage and costs, they will provide you with a quote or proposal. This quote describes the terms and conditions of the cover offered, including the types of risks covered, the limits of cover, the amount of the deductible or deductible, and the amount of the premium.

If you decide to accept the quote or proposal from the insurance company, you will need to sign a policy contract or agreement. This agreement outlines the terms of coverage, including the premium payment schedule and any exclusions or limitations on coverage.

It is essential to read the policy contract carefully and ensure that the cover and terms meet your business needs. If you have any questions or concerns about the policy contract, please contact your insurance agent or intermediary to discuss.

Conclusion

In short, a commercial insurance questionnaire is an essential tool for businesses seeking coverage for their operations. By providing insurers with detailed information about their activities and potential risks, companies can ensure they are getting the right level of coverage for their needs. While completing the questionnaire can be time-consuming and detailed, it is an important step in the process of obtaining commercial insurance coverage.